Dina Flynn, federal capture director with Cisco Systems, Inc., recently spoke with ArchIntel regarding significant lessons and challenges within competitive intelligence, how to analyze competition and customers, and how technology could offer insight into the practice. She also discussed the benefits and limitations of Porter’s Model and creating a strategy for a competitive intelligence team.

“Implementing a competitive intelligence program is critical. If a company wants to leverage their success, I’d focus time and energy to develop a program. People tend to think that these programs require huge teams of people and high dollar resources, which is not the case. It’s intimately built into the capture process. I am certain there would be a positive correlation to the amount of deals they win.”

ArchIntel: What are some of the most significant lessons learned throughout your career in competitive intelligence?

“The most significant lesson I’ve learned is understanding the context, background and experience of my competitive intelligence team. This is critical because you have to rely upon the information they provide. Having that trust built, in their skills and background, is essential.

That segues into the hesitation to trust information and summaries derived from artificial intelligence (AI). If you don’t know the context of the information, it becomes difficult to effectively craft competitive intelligence reports.

I have to trust my team because they may have inherent biases or views. You have to consider how that would impact the information provided to the larger team. The concept of competitive intelligence is taking these little nuggets and creating a tangible report to inform decision makers.

We all have biases that we may not realize, and they are dependent on our past. This even affects how you look at information. With any piece of data, you can interpret it in a variety of ways, so you have to understand the way you analyze data.”

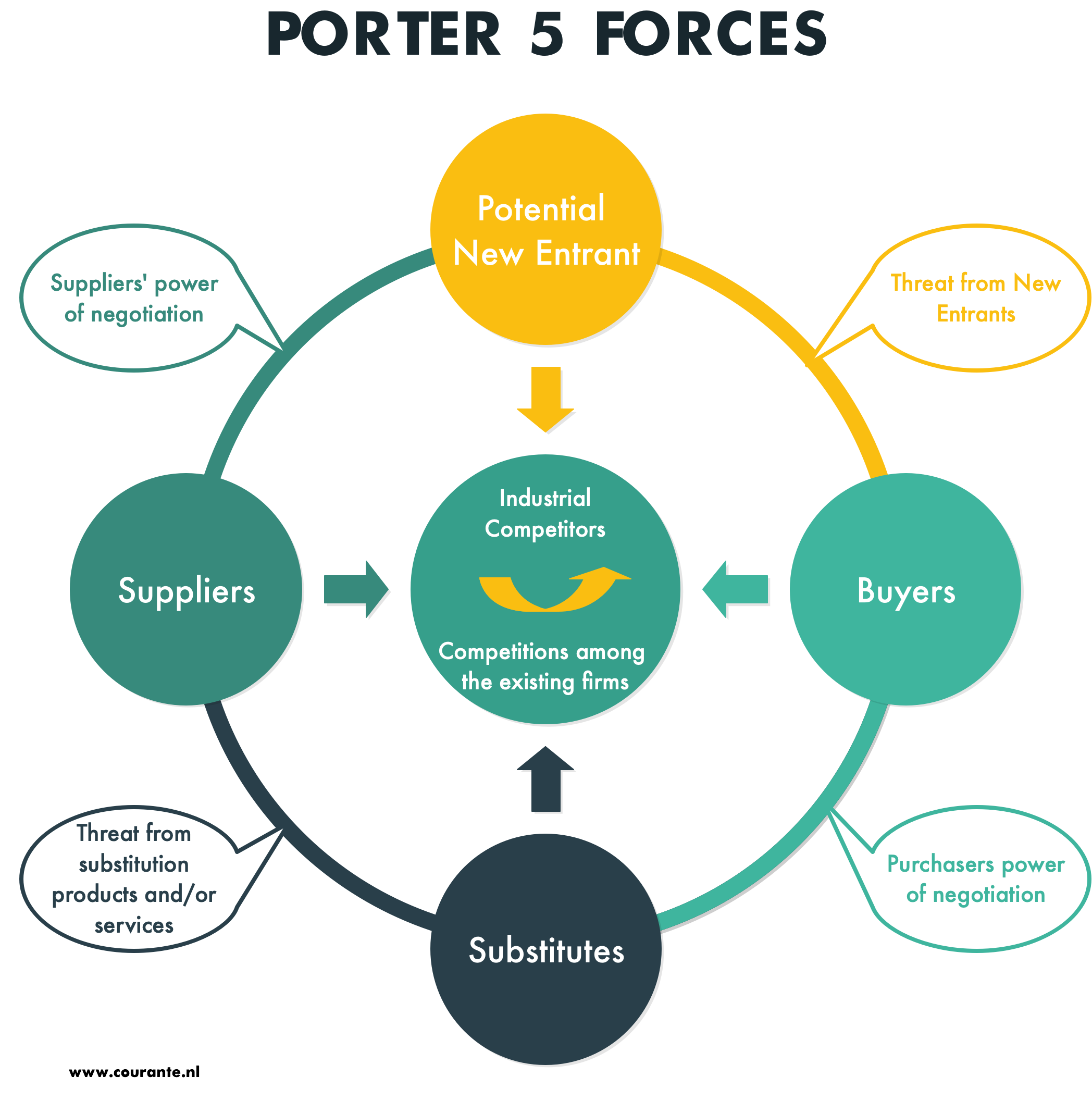

ArchIntel: How useful is Porter’s Model while conducting competitive analysis?

“Porter’s model can be very effective when you’re researching technology companies, trends and relevance. That model highlights the differences and how you’re impacting society or industry. However, from a system integrator perspective, it’s much more about pricing and how competitors organize their contracts and their operations to get the best cost down.

“Porter’s model can be very effective when you’re researching technology companies, trends and relevance. That model highlights the differences and how you’re impacting society or industry. However, from a system integrator perspective, it’s much more about pricing and how competitors organize their contracts and their operations to get the best cost down.

That really drives integrators in their proposals. In the last few years, there has been an emphasis on the technology that they add into their proposal that makes a bigger change. So some of that can be evaluated, but it presents a different way to analyze your competition and the horizon.

In terms of our analysis, it depends on how strongly you feel those offerings will impact your business. Sometimes you have a gut feeling of what the outcome should be. The operator has to analyze how they will present this information, which could result in inherent biases.

There are times when you want the data to help you provide the answer you think it should be, versus what the data is telling you.”

ArchIntel: How do you remove some of the inherent biases?

“You have to pay attention to your data. If you start seeing information that changes your perspective, it’s almost harder to go and find something that opposes it. The good analysts are ones that really try to find multiple sources. I look for a competitive intelligence report that doesn’t just have a summary, but includes the different data sources to see corroboration.

I urge my team to try to find different functions, drawing from a business development angle. If they don’t understand context and how the competition was operating, that is a negative. For example, within the government, we have industry days.

It is critical to note who attended because most people are not going to announce that they’re going to bid on an opportunity. You can draw conclusions of your competition based on the companies that attended an event. It also shows you which companies didn’t attend that you thought should be there.

That is a critical component to see in person versus read in an after-action report. I encourage my team to attend these events to gain an understanding of what that customer wants and the competition.

That drives our perspective of an opportunity, so we don’t solely rely on the data points of past contracts. We have a better perspective and a better analysis versus only having a report. We’re using other data and tools.”

ArchIntel: How can an analyst use AI to enhance their experience or analysis?

“I see our industry using past pricing. For instance, when you complete an entire proposal, you have a readout to understand more about your competition, such as final prices. A good price analyst will figure out how to change pricing to remain competitive.

“I see our industry using past pricing. For instance, when you complete an entire proposal, you have a readout to understand more about your competition, such as final prices. A good price analyst will figure out how to change pricing to remain competitive.

That information is put in a database to keep track of a competitor’s bid. That information can create an AI algorithm to help you understand the type of work and the competitor. There could be some preliminary insights derived from an AI model.

Here’s the problem with AI: if a customer really is unhappy with a company, they’re not going to want to work with them, regardless of price. They’re probably not going to get the award again because of this recruitment information. That information is not given through your AI model.

While this insight is not shown in the data, it’s critical for us to keep going after this opportunity because we have a good opportunity to win it based on human intelligence. AI only reviews pricing data and proposals in the past and your bid decision internally.

With AI, you have to keep questioning the value of it. It can be great for certain decisions, but there’s always going to be additional human insight that AI will not give you.”

ArchIntel: When do you decide to bid on an opportunity?

“It’s about your mission and strategy as a company. For instance, if we want to expand in a particular area, we’ll be willing to spend more money, from a capture perspective, to work with that customer.

Sometimes, we have these other six areas we need to go after, so we don’t have enough money to focus on those resources on a different opportunity. Companies may take more chances and look at a bid with the lower percentage when out of the gate. That would be an entirely different way to conduct competitive intelligence because you don’t fully understand the customer or market.

You’re going to have to scramble to find teammates and other people to help you fortify your ability to analyze that customer. Your strategy and your mission guide you because that is what we’ve told our company holders that we’re going to go and expand in that area this year.”

ArchIntel: What are some of the common challenges in breaking into a new market?

“You have to get so boots-on-the ground to really understand what that customer wants, what they’re doing and who they already trust. It’s all about taking on the incumbent employees because that’s what happens in most markets. The incumbents will leave the one company that held a contract last week and go to a new one next week.

“You have to get so boots-on-the ground to really understand what that customer wants, what they’re doing and who they already trust. It’s all about taking on the incumbent employees because that’s what happens in most markets. The incumbents will leave the one company that held a contract last week and go to a new one next week.

You have to really study their salaries and market hold. It’s a very different mentality than having thousands of workers at your beck and call to be able to bid on projects and look at markets and trends.

When you enter a new market, it could be for completely different skill sets that customers need. They may have a different program management style or technology. You have to look at the market differently.

In some of these other smaller markets, you have to bring a different offering to your contract because the same people are going to be there day-to-day. Most customers want the same people they’ve worked with for years, so you’d have to bring in a different offering to unseat the current incumbent in that environment.

That’s where it would take more intelligence to find the nuances about the strategy and what you need to achieve an objective. You have to make yourself and your offerings different. That’s where competitive intelligence on your customer comes in. What are their objectives, what do we have to achieve?

It changes what competitive intelligence means from every opportunity. You have to change what you’re really trying to dissect and discover. We have to get our customers to crawl before they walk, then run. They’re not ready to run when you first break into a market.

Within your proposals, you would do a phased approach. You can’t be super aggressive because it’s really hard to turn around a battleship in a bathtub. You have to show them you can make it different. That’s when you look at that leadership influence because you have to consider the winning theme to put forward for your opportunity.”

ArchIntel: How is competitive intelligence in government contracting (GovCon) unique?

“It’s easier to collect the intelligence within government contracting because there has to be a reporting mechanism for the entities, contracts and the budgets. There’s already a mechanism in place to provide that information publicly. Within the commercial sector, You may not have access to the prices or contract elements.

It’s a lot harder to judge compared to the reporting tools the government uses. It would be really challenging to gather competitive intelligence in the commercial side versus what we get to do in the government.

However, there’s so much information in the government that it can be overwhelming all the data you get, but at least it’s there to find. It impacts how you conduct competitive intelligence, depending on the sector because of the reporting mechanisms they use.”